Washington CEO Magazine has this take on Spokane. I posted this comment.

Ron the Cop

Mr.Corliss,

I agree with this caveat. I’m not against quasi private/governmental redevelopment projects when the true costs and risks are fully disclosed, understood and equitably shared. With RPS the risks were not disclosed and in fact material facts were concealed from the public and the institutional bond investors. The public had to make the initial bond investors whole who were defrauded and successfully sued. The public took on most of the risk and got left holding the empty bag while the principals walked away with the pot. Had the public paid up front, the true costs would have been much less and the same beneficial effects would have occurred.

Ron the Cop

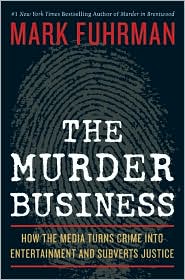

Friends of Mark FuhrmanSpokane – Good news, bad numbers

There are a lot of good things happening in Spokane, and it all starts with River Park Square. Whatever you think about the way that infamous parking garage was financed, there’s no denying that River Park Square worked. It brought new life to a mostly moribund downtown district, and with its shops, restaurants, bars and cinema, gave Spokane residents a reason to be downtown.

With that new life came new investment. The once-abandoned Davenport Hotel is now the renovated heart of a new arts district, which includes theaters, galleries and nightlife.

Speaking of investments, Spokane is home to a couple aggressively expanding Northwest banks: Sterling Savings and AmericanWest. There’s more money in Spokane these days – FDIC figures show that Spokane County bank deposits have more than doubled over the past decade – a growth rate that’s slightly faster than the growth for the state as a whole.