I just received this comment from a friend with this excellent article in The Village Voice on the world’s economic meltdown.

AMEN! I said there are high folks on both sides of the aisle and in boardrooms that must be held accountable for their lack of due diligence and duty to the people e.g., go to jail and assets forfeited! Here’s the way to do it. It’s all laid out in the US DOJ’s procedure manual for prosecuting RICO cases.

Like in Spokane (AKA Little Chicago) this a classic case of lack of sheepdogs willing or capable to ward off the wolves from preying on the flock. This is nothing more than a “con game” by crooks “cooking the books” in a pyramid scheme knowing full well the bubble would burst and placed bets that it would!

We shouldn’t reward them with any bailout money and should seize all their assets. President Obama are you game to change the status quo? This is the change the people are demanding – not business as usual by another set of crooks now in power.

These folks need to be taken down like any ordinary crooks that run con/fraud schemes on the flock. They are not above the law.

Book’em Danno!

—

RBT

AKA Ron the Cop

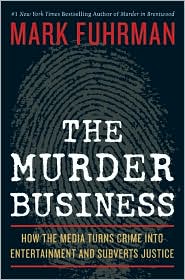

http://friendsofmarkfuhrman.

*****

Thanks, Edward. This Village Voice story is a superb piece of reporting. Better than any I’ve seen, it explains the “gangsterization” of government that lead to our present economic crisis. It shows how it came from “control fraud” stemming from the top tier of corporate leadership. And it explains why the current bailout scheme “often seems to be completing the scam by quietly passing the proceeds” to beneficiaries of the fraud instead of its taxpayer victims. It explains why RICO prosecution is the only real solution, and how President Obama, with his Wall Street background, is smart enough to know that. Does Obama have the backbone to engage in an epic confrontation with white collar criminals in order to protect the desperately hopeful citizens who elected him? His first two weeks in office are very discouraging. If Obama can look into his soul and find a purpose that matches the rhetoric that sent him to office he has a chance of becoming one of history’s greatest leaders. If not, if there’s no “there” there, Bernie Madoff will likely look like a Boy Scout compared to our charismatic new President. I commend this article to every citizen wishing to hold government accountable. So much hangs in the balance. Best, Larry

WHAT COOKED THE WORLDS’ ECONOMY? NOT YOUR OVERDUE MORTGAGE

Sunday, 01 February 2009

By James Lieber

Reprinted from VILLAGE VOICE

[In this succinct article, James Lieber presents a clear and concise saga of

the global economic crisis and demonstrates its origin in fraud, from liar

loans to hedge funds on life support–all implemented through

incomprehensible FRAUD.–CB]It’s 2009. You’re laid off, furloughed, foreclosed on, or you know someone

who is. You wonder where you’ll fit into the grim new semi-socialistic

post-post-industrial economy colloquially known as “this mess.”You’re astonished and possibly ashamed that mutant financial instruments

dreamed up in your great country have spawned worldwide misery. You can’t

comprehend, much less trim, the amount of bailout money parachuting into the

laps of incompetents, hoarders, and miscreants. It’s been a tough century so

far: 9/11, Iraq, and now this. At least we have a bright new president.

He’ll give you a job painting a bridge. You may need it to keep body and

soul together.The basic story line so far is that we are all to blame, including

homeowners who bit off more than they could chew, lenders who wrote absurd

adjustable-rate mortgages, and greedy investment bankers.Credit derivatives also figure heavily in the plot. Apologists say that

these became so complicated that even Wall Street couldn’t understand them

and that they created “an unacceptable level of risk.” Then these blowhards

tell us that the bailout will pump hundreds of billions of dollars into the

credit arteries and save the patient, which is the world’s financial system.

It will take time—maybe a year or so—but if everyone hangs in there, we’ll

be all right. No structural damage has been done, and all’s well that ends

well.Sorry, but that’s drivel. In fact, what we are living through is the worst

financial scandal in history. It dwarfs 1929, Ponzi’s scheme, Teapot Dome,

the South Sea Bubble, tulip bulbs, you name it. Bernie Madoff? He’s peanuts.Credit derivatives—those securities that few have ever seen—are one reason

why this crisis is so different from 1929.

Read More